You will need a license if you want to sell real estate in New York. It's not hard and you can get it done quickly if the right information is available.

How to Get a New York Real Estate License

Enrolling in a 75-hour state-approved pre-license course is the first step towards getting your license. This step can be the most time-consuming, but there are many other options available. These include online and on demand courses that you can take as your schedule allows.

After you have completed all your coursework, the eAccessNY Occupational licensing management system will allow you to register for the state examination. You should bring a photocopy of your "Summary of Your Submission", page from eAccessNY, and a form of government-issued identification to the test.

Make it a habit to pay attention and take notes during your study sessions. This will increase your chances of passing the state exam in the first attempt.

Next, you will need to apply for a New York Department of State real estate license (DOS). You can either apply online or via mail. Make sure you include your fingerprints as well as a background check. Also, submit any additional documents the state may require.

A $65 application fee must be paid. You will also need to submit a photo of your pocket card. This can be done with your credit card or by sending a money order to the Department of State.

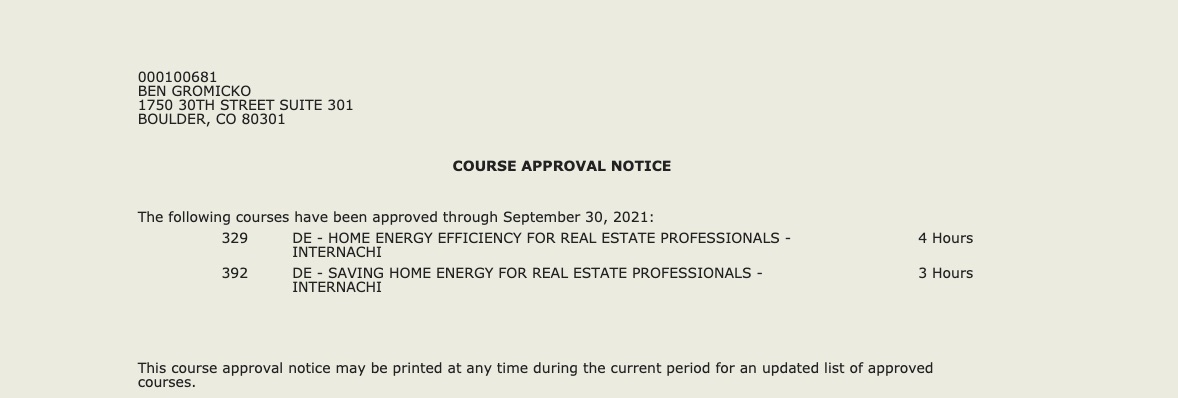

Once your application is processed, the DOS sends you a notice confirming your license approval. Then you can begin working with brokers in New york. Find a broker that is familiar with you and who can help you succeed within the real estate industry.

Your broker will also help you to develop your marketing strategies. Make sure that they are clear about your goals and objectives. This can be especially important if you're a newcomer to the industry.

Finding a Great Broker

Your success as a real-estate agent is directly affected by the quality of your broker. Do your research before you choose a company. A good broker will be able to provide you with a range resources, such a comprehensive training programme and access tools that can help build your real-estate business.

A broker who is a professional will offer marketing materials and support for your business's launch. It's a good idea also to select a brokerage that values transparency as well as education.

How much is a New York real estate license?

A few factors affect the cost of a New York real estate license. It can also vary depending on how quickly you're able to pass your real estate exam and how much you plan on earning during your career.

FAQ

What should I look for in a mortgage broker?

A mortgage broker is someone who helps people who are not eligible for traditional loans. They search through lenders to find the right deal for their clients. This service is offered by some brokers at a charge. Others offer no cost services.

What are the downsides to a fixed-rate loan?

Fixed-rate loans are more expensive than adjustable-rate mortgages because they have higher initial costs. If you decide to sell your house before the term ends, the difference between the sale price of your home and the outstanding balance could result in a significant loss.

What is the cost of replacing windows?

Window replacement costs range from $1,500 to $3,000 per window. The cost to replace all your windows depends on their size, style and brand.

How do I know if my house is worth selling?

It could be that your home has been priced incorrectly if you ask for a low asking price. You may not get enough interest in the home if your asking price is lower than the market value. Our free Home Value Report will provide you with information about current market conditions.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

How to become a broker of real estate

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

Next you must pass a qualifying exam to test your knowledge. This means that you will need to study at least 2 hours per week for 3 months.

This is the last step before you can take your final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

You are now eligible to work as a real-estate agent if you have passed all of these exams!