Depending on the situation, real estate agents can be paid in a variety of ways. In general, a realtor is paid in the form of a commission, and a percentage of the sale price. The listing broker and buyer's agent split these commissions. An agent's fee can be fixed or negotiated in conjunction with the seller.

It is common to charge a percentage of the sale amount to a realtor to pay them. This is called a commission, and is often a percentage of the final purchase price, which can vary from a few hundred dollars to several thousands of dollars. Most sellers will accept a commission between five and six per cent. Real estate agents might earn a higher commission depending on where they are located.

You can be paid in many ways as a realtor. Some agents are self-employed, while other brokerage firms handle the business. It is important to understand what you are getting into if you decide to become a realtor. You must be willing to work hard and compete.

You can get a free estimate of the home's value to find out how much a real estate agent makes. You'll need to estimate the home's value, as well as its taxes and closing costs, to figure out how much you'll be earning.

A typical Realtor earns $44,000 in the United States each year. Although this may sound like a lot to some, many realtors make more than the full-time salary. You can earn more money by having more experience. A new agent typically earns a base salary in excess of tens and thousands, plus a small commission.

Real estate takes a lot of work, so it is not surprising that agents charge a commission. However, a realtor can keep all of their earnings for themselves, or they can use the money to help their clients. For instance, if you're buying a house and want to save on closing costs, you can ask the seller to pay for marketing expenses.

One of the newest trends in real estate is a flat fee or "finder's fee" type of commission. This arrangement usually saves sellers around nineteen thousand bucks in commissions. Consider a percentage-based service fee. You will earn a meaningful bonus if the home you own sells for more that you paid.

Besides earning you a nice chunk of cash, real estate agents are also responsible for bringing buyers and sellers together. A realtor, among other responsibilities, will sign the contract, prepare the documents, and update the status of a property when it goes under contract.

It's important to know that you'll be paying a lot of fees before you even move into your new home. These fees can add up quickly. You can save a lot of money by using an escrow service. An escrow service will hold your money up until the transaction closes, and then transfer the remaining funds to your agent.

FAQ

How long does it take to get a mortgage approved?

It is dependent on many factors, such as your credit score and income level. It takes approximately 30 days to get a mortgage approved.

Should I use a broker to help me with my mortgage?

If you are looking for a competitive rate, consider using a mortgage broker. Brokers are able to work with multiple lenders and help you negotiate the best rate. However, some brokers take a commission from the lenders. Before signing up, you should verify all fees associated with the broker.

How many times can my mortgage be refinanced?

It all depends on whether your mortgage broker or another lender is involved in the refinance. In both cases, you can usually refinance every five years.

What should I do before I purchase a house in my area?

It depends on how long you plan to live there. Save now if the goal is to stay for at most five years. But, if your goal is to move within the next two-years, you don’t have to be too concerned.

What are some of the disadvantages of a fixed mortgage rate?

Fixed-rate mortgages have lower initial costs than adjustable rates. If you decide to sell your house before the term ends, the difference between the sale price of your home and the outstanding balance could result in a significant loss.

Do I require flood insurance?

Flood Insurance covers flooding-related damages. Flood insurance helps protect your belongings, and your mortgage payments. Find out more information on flood insurance.

What should I look for when choosing a mortgage broker

A mortgage broker assists people who aren’t eligible for traditional mortgages. They shop around for the best deal and compare rates from various lenders. This service is offered by some brokers at a charge. Others offer no cost services.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to become a broker of real estate

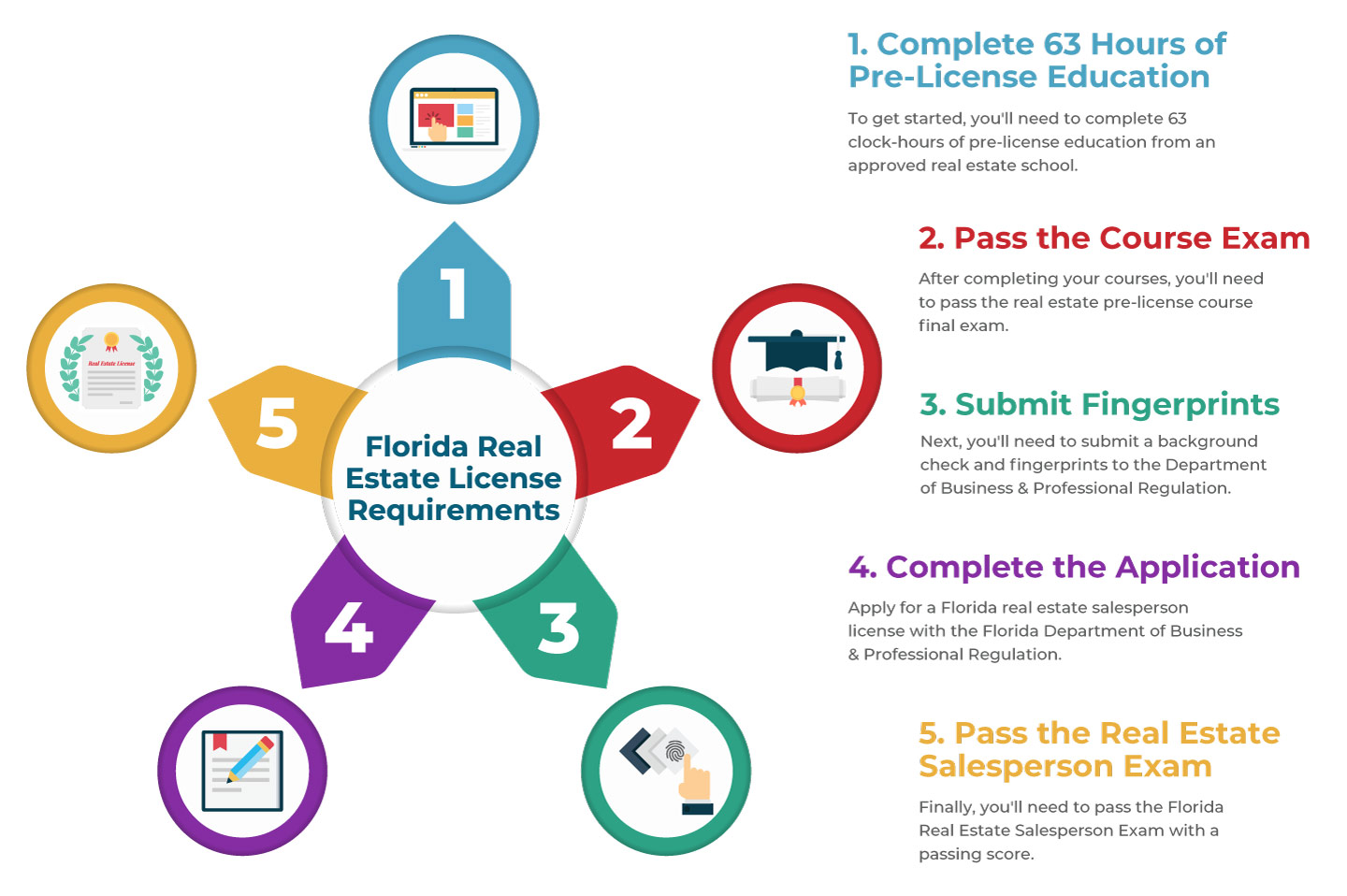

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This involves studying for at least 2 hours per day over a period of 3 months.

This is the last step before you can take your final exam. You must score at least 80% in order to qualify as a real estate agent.

You are now eligible to work as a real-estate agent if you have passed all of these exams!