An in-depth knowledge of the local property market can make it easier to grow your business. It is a great idea to research the history, culture, as well as geography of the area. It is also possible to get an idea about the fastest routes to the airport or other important locations.

You should also do a comparative market analysis to determine the best possible price for a property. Your property's price should be determined using factors such price per sq. foot, market balance, as well as other factors. You can check the current listing status of your area and determine the percent of properties that are sold.

You should also have an idea of the most common homebuying activities, including who is interested in buying a home in your area and what the average buyer is looking for in a new house. The number of potential buyers is a good indicator about the strength of your local market. There have been many changes in the real estate market over the years. It is important that you are aware of current conditions.

Your first step in real estate market analysis is to examine the available listings. The MLS can tell you the most basic information about each listing, and how old the listing is. You can also see how many listings are active, their listing age, and the most recently sold listings in your local area. You can use this information to compare the value of your listed property to those that have recently sold in the area. This is a great tool to determine the true market value of your listing and make you more attractive to other agents.

The best thing about the MLS is that it also provides a list of similar properties that have sold recently. These are "comps" which are great for comparing similar properties that are being sold in your neighborhood.

The MLS also provides a host of helpful features like a database with real estate-related websites that you can promote your listings. You can build your reputation as an expert in your market by creating a website that is well designed.

The real estate market is a complicated mix of local, national, and international factors, and it is essential that you know your local area before you begin to evaluate the value of a specific property. You will be a better buyer if you have a better understanding of the market. This will also increase your chances of succeeding in this constantly changing industry. A thorough understanding of the local market will help you determine your purchasing power and the number of offers you can expect to get in a given time period. Only a thorough comparative market analysis can help you determine the best price for your property.

FAQ

How long does it take for a mortgage to be approved?

It all depends on your credit score, income level, and type of loan. It takes approximately 30 days to get a mortgage approved.

How do you calculate your interest rate?

Interest rates change daily based on market conditions. In the last week, the average interest rate was 4.39%. Divide the length of your loan by the interest rates to calculate your interest rate. For example, if $200,000 is borrowed over 20 years at 5%/year, the interest rate will be 0.05x20 1%. That's ten basis points.

What are the chances of me getting a second mortgage.

Yes. However it is best to seek the advice of a professional to determine if you should apply. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

Is it possible to sell a house fast?

It may be possible to quickly sell your house if you are moving out of your current home in the next few months. However, there are some things you need to keep in mind before doing so. First, you must find a buyer and make a contract. Second, you need to prepare your house for sale. Third, your property must be advertised. Finally, you need to accept offers made to you.

Is it better for me to rent or buy?

Renting is generally less expensive than buying a home. However, renting is usually cheaper than purchasing a home. Buying a home has its advantages too. For example, you have more control over how your life is run.

Do I need flood insurance

Flood Insurance covers flooding-related damages. Flood insurance helps protect your belongings, and your mortgage payments. Learn more about flood coverage here.

What is a Reverse Mortgage?

Reverse mortgages are a way to borrow funds from your home, without having any equity. This reverse mortgage allows you to take out funds from your home's equity and still live there. There are two types of reverse mortgages: the government-insured FHA and the conventional. If you take out a conventional reverse mortgage, the principal amount borrowed must be repaid along with an origination cost. FHA insurance will cover the repayment.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to become real estate broker

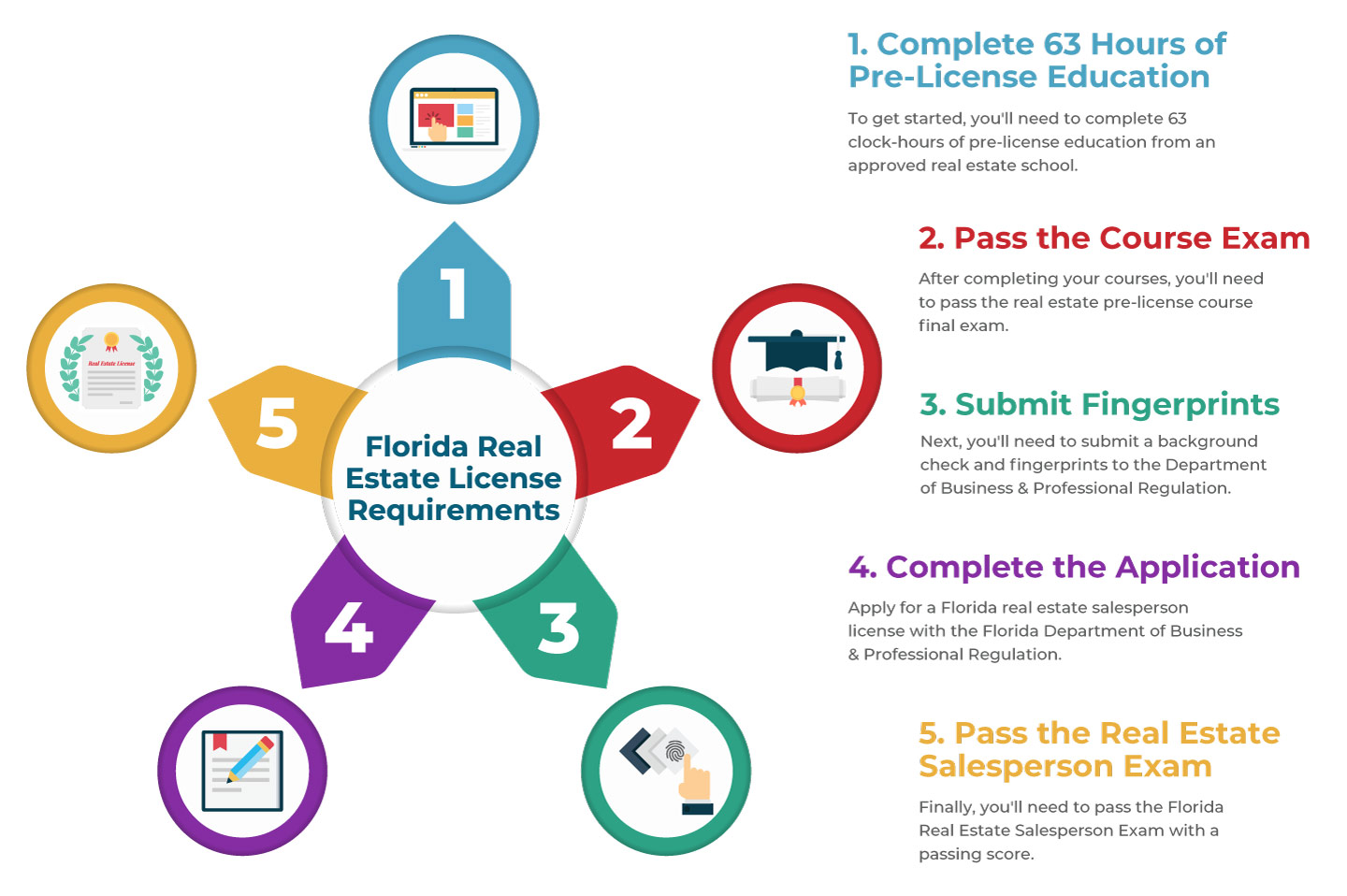

Attending an introductory course is the first step to becoming a real-estate agent.

Next you must pass a qualifying exam to test your knowledge. This means that you will need to study at least 2 hours per week for 3 months.

After passing the exam, you can take the final one. You must score at least 80% in order to qualify as a real estate agent.

These exams are passed and you can now work as an agent in real estate.