Real estate investment can be a good option if you have a 100k capital and want to make a passive income with predictable returns. Investing in real estate gives you the opportunity to build enormous equity with little or no work. You can get a million-dollar house for as little as 100k and still build substantial equity over time.

Real estate is the best way to invest.

Real estate is the best investment option if you have a hundred thousand dollars. Not only does real estate earn a substantial cash flow each year, but it can also provide a solid personal asset for future generations. If you're looking to diversify your portfolio, investing in real estate can be a good option.

Passive investments are possible with IRAs

An IRA could be a good investment option for 100k, as well as offering tax benefits. You also have more control over your investments than a traditional 401(k), with the option to invest in stocks and ETFs as well as other asset classes. The right investment strategy can help you grow your investments over the long-term while also taking advantage of tax incentives.

Mutual funds

If you have a $100k investment, you should be careful about which kind of funds you choose. Investing in stocks is risky, especially for those who are not careful. Bonds on the other side are less risky. However, you'll earn lower returns with them. It is important to take into account your age and overall health. You should also consider whether your finances can be kept in one location for more than five years.

ETFs

If you're looking to invest a hundred thousand dollars, you should consider making the switch to exchange-traded funds or mutual funds. These passive investments have low fees and can be set up to automatically invest recurring amounts over time. ETFs have many benefits over individual stocks. The barrier to entry is low, making them one of the most preferred investing strategies.

SIPPs for DIY

A DIY SIPP is a great option for your first 100k. Here are some factors to consider before investing. First, you will need to select an investment platform. The amount you wish to invest is another important decision. Vanguard funds might be an option. You can also look into their SIPP. If that is not possible, you may want to investigate other SIPP providers like Hargreaves Lansdown oder Fidelity.

Tax benefits of investing in a 401(k)

There are many tax incentives to investing in your 401(k). The first benefit is that it's tax-deferred, which means your money grows tax-deferred until you withdraw it at retirement. This tax-deferral benefit applies to both Roth 401(k), and traditional accounts.

FAQ

How do I get rid termites & other pests from my home?

Termites and many other pests can cause serious damage to your home. They can cause severe damage to wooden structures, such as decks and furniture. To prevent this from happening, make sure to hire a professional pest control company to inspect your home regularly.

What should you look for in an agent who is a mortgage lender?

A mortgage broker is someone who helps people who are not eligible for traditional loans. They work with a variety of lenders to find the best deal. Some brokers charge a fee for this service. Others offer free services.

How much money do I need to save before buying a home?

It depends on how long you plan to live there. If you want to stay for at least five years, you must start saving now. If you plan to move in two years, you don't need to worry as much.

Is it better buy or rent?

Renting is generally cheaper than buying a home. It is important to realize that renting is generally cheaper than buying a home. You will still need to pay utilities, repairs, and maintenance. There are many benefits to buying a home. You'll have greater control over your living environment.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

How to become a broker of real estate

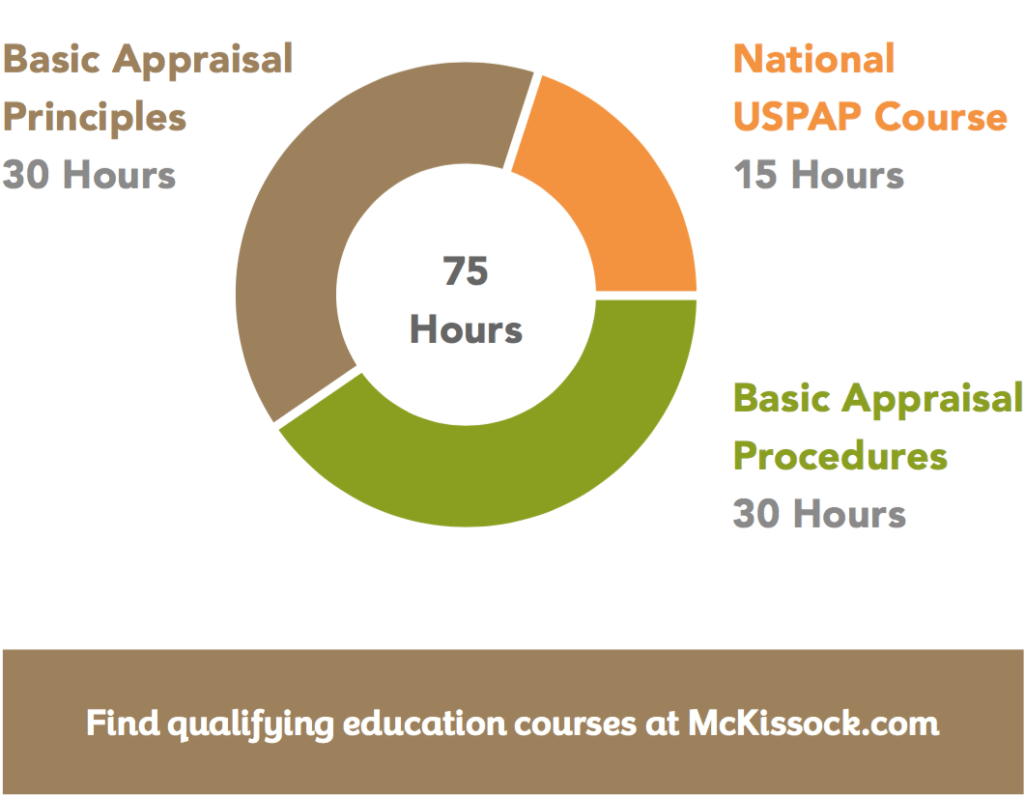

You must first take an introductory course to become a licensed real estate agent.

Next, pass a qualifying test that will assess your knowledge of the subject. This involves studying for at least 2 hours per day over a period of 3 months.

Once you have passed the initial exam, you will be ready for the final. You must score at least 80% in order to qualify as a real estate agent.

All these exams must be passed before you can become a licensed real estate agent.