Every time a buyer or seller signs an Exclusive Rights to Represent Agreement with you, you will receive a commission as a real-estate agent. Sometimes you may feel compelled to ask your family or friends for help, but this is not necessary. One agent who closes a $2,000,000 sale earns $120,000 commission. That's more than most workers make in a single year. But, you must consider other factors when making your decision.

Your first commission as an agent in real estate

It can be scary to receive your first real-estate commission if you haven't worked in this field before. You can get help from a Managing broker to guide you through the first year. They'll provide access to the MLS, marketing tools, and learning opportunities, as well as offer you the opportunity to network.

NAR membership benefits

The NATIONAL ASSOCIATION OF REALTORS (NAR), provides many resources to agents. The organization allows members to deduct some of their business expenses. This includes NAR membership dues. These benefits go well beyond what a real agent makes in income. You can enjoy a number of exclusive benefits as a NAR member.

Commissions for real estate agents

When a home is sold, real-estate agents are paid a commission. The seller pays the commission and takes a percentage of the final sale price. Buyers' agents also receive a share of the commission. These commissions are known as cooperating commissions and are usually built into the price of a home. However, there are some instances when a buyer's agent receives a commission from the selling agent.

NYC income tax for real estate agents

When it comes to selling real estate in New York City, the tax situation is not straightforward. It is important to understand the tax implications of different tax rates and exemptions. Here are some tips for real-estate agents to avoid paying taxes in New York City. You will need to register the limited liability business. It is different from a regular individual. Once you have registered the company, you can file your taxes as normal.

Upscale your real estate market

You can increase your real estate earnings by targeting higher-priced markets. These markets can help agents increase their income, even though the average realty commission is between five and six percent. A 5% commission earned from a house sold for $250,000 can net them $2,500. While a 5% percentage on a house listed for $350,000 will net them $4375, a commission of 5% on a house priced at $350,000 will net them $4,375. Finding the right market is key.

FAQ

What are the benefits to a fixed-rate mortgage

Fixed-rate mortgages allow you to lock in the interest rate throughout the loan's term. This will ensure that there are no rising interest rates. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

What time does it take to get my home sold?

It depends on many different factors, including the condition of your home, the number of similar homes currently listed for sale, the overall demand for homes in your area, the local housing market conditions, etc. It may take up to 7 days, 90 days or more depending upon these factors.

How do I calculate my interest rates?

Market conditions can affect how interest rates change each day. The average interest rate for the past week was 4.39%. Add the number of years that you plan to finance to get your interest rates. Example: You finance $200,000 in 20 years, at 5% per month, and your interest rate is 0.05 x 20.1%. This equals ten bases points.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

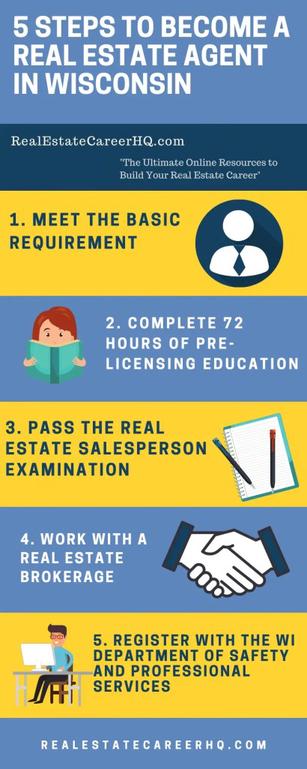

How to be a real-estate broker

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

Next, pass a qualifying test that will assess your knowledge of the subject. This involves studying for at least 2 hours per day over a period of 3 months.

This is the last step before you can take your final exam. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

Once you have passed these tests, you are qualified to become a real estate agent.