There are many ways to make money with property. There are many ways you can make cash from property. Here are some tips and strategies that will help you get started. No matter how good your plan is, you should allow yourself some flexibility for unexpected setbacks and costs. Below are some of our most-recommended methods.

Rooms to rent in your home

Renting out rooms in your home is an option if it's your own property. Although you don't have to rent out your house, it can make you extra cash. Here are some tips to help you get started. Prepare the room to be rented. Verify that the heating and electricity are working properly. If there is a bath, tell the tenant. Learn how to market the space.

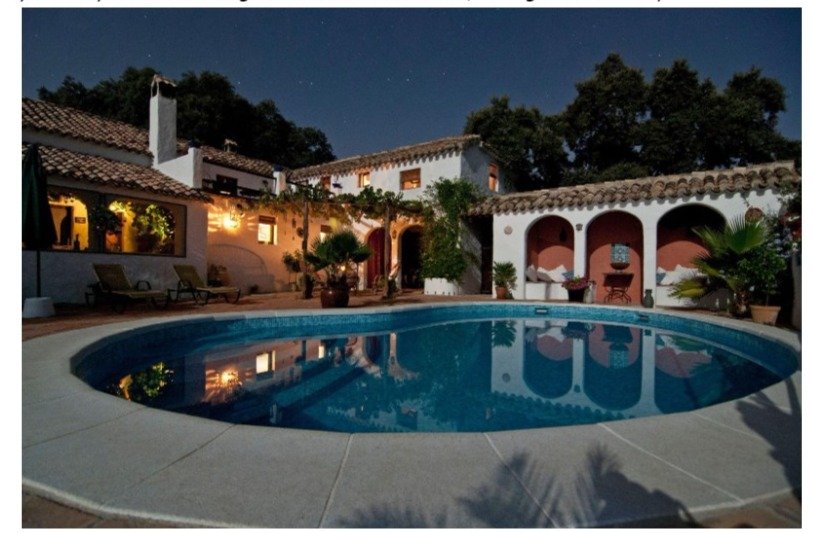

Investing to buy a second house

There are many advantages to purchasing a second house. You can enjoy the comforts of your second residence while still making money. Part of your savings can be used to buy a second home, while the rest can go towards an investment property. Even if the second house is not used, it can be rented out to make a profit. A second home is a great way to build your portfolio and get the financial security that you want.

Foreclosure purchase

Here are some tips to help you invest in foreclosures. Before you purchase, it is important to create a plan. There are two common strategies for buying foreclosures: flipping or holding the home for the long term. Both of these strategies can bring you great profits. However, you need to determine which option is best for you and your budget. These tips will help you make the most of your money.

Investing in land raw

For real estate investors, investing in raw land can bring many benefits. Raw land can be converted into numerous entities, including commercial and residential, unlike commercial and residential property. It doesn't matter if you invest in a single unit of land or several units. The potential for profits is enormous. Raw land can increase in value over time which will allow you to make lucrative long-term returns.

Investing In Multi-Family Housing

It is an excellent way to increase your net worth over time. Multifamily properties serve a vital need, so many people are interested in investing. These properties allow people to own a home, even if they don't have the money. These properties are also risk-free. But it is crucial to review all details of these properties and to speak with an expert. Multifamily property owners often purchase properties in the hope of increasing their income or decreasing the cost of homeownership.

FAQ

What amount should I save to buy a house?

It depends on how much time you intend to stay there. Save now if the goal is to stay for at most five years. However, if you're planning on moving within two years, you don’t need to worry.

What are the benefits associated with a fixed mortgage rate?

Fixed-rate mortgages guarantee that the interest rate will remain the same for the duration of the loan. This means that you won't have to worry about rising rates. Fixed-rate loans offer lower payments due to the fact that they're locked for a fixed term.

How much money do I need to purchase my home?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. The average selling price for a home in the US is $203,000, according to Zillow.com. This

Is it possible sell a house quickly?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. However, there are some things you need to keep in mind before doing so. First, you need to find a buyer and negotiate a contract. Second, prepare your property for sale. Third, it is important to market your property. Finally, you should accept any offers made to your property.

Are flood insurance necessary?

Flood Insurance protects from flood-related damage. Flood insurance protects your possessions and your mortgage payments. Learn more about flood coverage here.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

How to Rent a House

Renting houses is one of the most popular tasks for anyone who wants to move. However, finding the right house may take some time. When you are looking for a home, many factors will affect your decision-making process. These factors include the location, size, number and amenities of the rooms, as well as price range.

You can get the best deal by looking early for properties. Ask your family and friends for recommendations. This will ensure that you have many options.