Diversification is crucial to the success and sustainability of your real estate investment portfolio. Diversifying means not putting all your eggs in one basket, but striking a balance between risk and reward. Diversifying your investments means diversifying in property types and locations. Diversification could include purchasing another property or renting it out. This is one strategy that has been proven to generate high profits for many investors. For more information on real estate investing, please read the following:

Building a real estate portfolio

Based on your goals, a mix smart investments should be made that generate cash flow. For example, a portfolio could contain properties with stable tenants, potential for growth, and affordable management. While the exact formula depends on your personal goals and risk tolerance, following these steps can help you build a portfolio that will meet those goals. Here are a few tips for building a real estate portfolio.

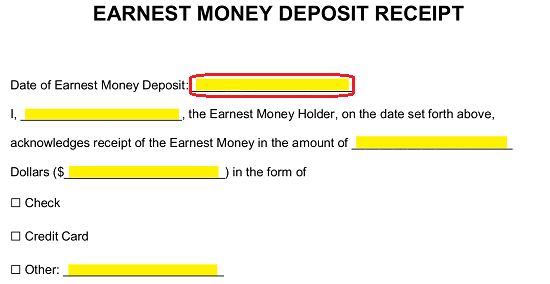

Building a real estate portfolio is just like any other business. Finding a buyer will be necessary, as well as arranging financing. You might also need to find funding for the next property you are investing in. A detailed business plan will help you make this process easier. Building a portfolio of real estate properties will help you make smart decisions about how each property should be valued. You must also decide how to finance each property in the portfolio.

Tokenization real estate

For businesses with real estate properties in progressive jurisdictions, tokenization of real property portfolio investment is an option. Tokenized real property investment allows investors to purchase the real estate. This is often an income-producing asset. The real estate security token holders can decide how to distribute the income. These smart contracts make it possible for investors to take these decisions without having to go through the process. This reduces transaction costs as well as time. Tokenization of real estate portfolio investment requires that a real estate security be located in a country with strong private property rights protection laws, which makes it difficult to use the same legal framework in countries outside of the U.S.

Many investors are currently holding real estate through timeshare schemes. Tokenization allows both investors and owners to be flexible and decreases the traditional illiquidity in real estate. Blockchain technology means that tokens can be used to make investments in real estate more easily than traditional investment avenues. If you are looking for an easy way to invest real estate, tokenization might be the right choice.

Calculating returns on your real estate investments

When calculating your returns on real estate portfolio investments, there are many variables that you need to consider. You will make a difference in the value of your property, including its condition, financing terms and market conditions. You should set a realistic goal, monitor your investments closely and be clear about what you are investing in. If your ROI is not what you expected, you may need to revise your strategy.

Another important factor to consider when calculating the ROI of a real estate investment is the inflation rate. Real estate can be a stable investment but REITs can have volatile returns. The capitalization ratio (CAPR), which measures investment performance, can be used to determine it. This figure is calculated using an investor's net operational income over a one-year period and divided by the current property value. This information is helpful when comparing properties with similar capitalization rate.

Investing in multiple rental properties

Multi-tenant rental properties are a great way to diversify your portfolio and increase your real estate investment. It is possible to generate multiple streams from the same property. This can prove beneficial in uncertain economic times. This strategy can be challenging to finance. Here are some ideas to help you get started. Research is key before you decide to invest. Understanding the market is key.

Take into account your savings ability. Before you invest in a rental property, you must have sufficient cash to cover a 20% downpayment. Rental experts recommend setting aside a financial cushion to buy multiple rental properties. This is especially true if your goal is to purchase multiple properties. If you purchase a new property within two to three years of the one you have, you might have enough cash to pay your monthly expenses.

FAQ

What is a "reverse mortgage"?

A reverse mortgage is a way to borrow money from your home without having to put any equity into the property. It allows you access to your home equity and allow you to live there while drawing down money. There are two types: conventional and government-insured (FHA). With a conventional reverse mortgage, you must repay the amount borrowed plus an origination fee. FHA insurance covers your repayments.

How can I get rid Termites & Other Pests?

Termites and many other pests can cause serious damage to your home. They can cause serious damage to wood structures like decks or furniture. It is important to have your home inspected by a professional pest control firm to prevent this.

What should I look out for in a mortgage broker

A mortgage broker assists people who aren’t eligible for traditional mortgages. They search through lenders to find the right deal for their clients. Some brokers charge a fee for this service. Some brokers offer services for free.

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to become a real estate broker

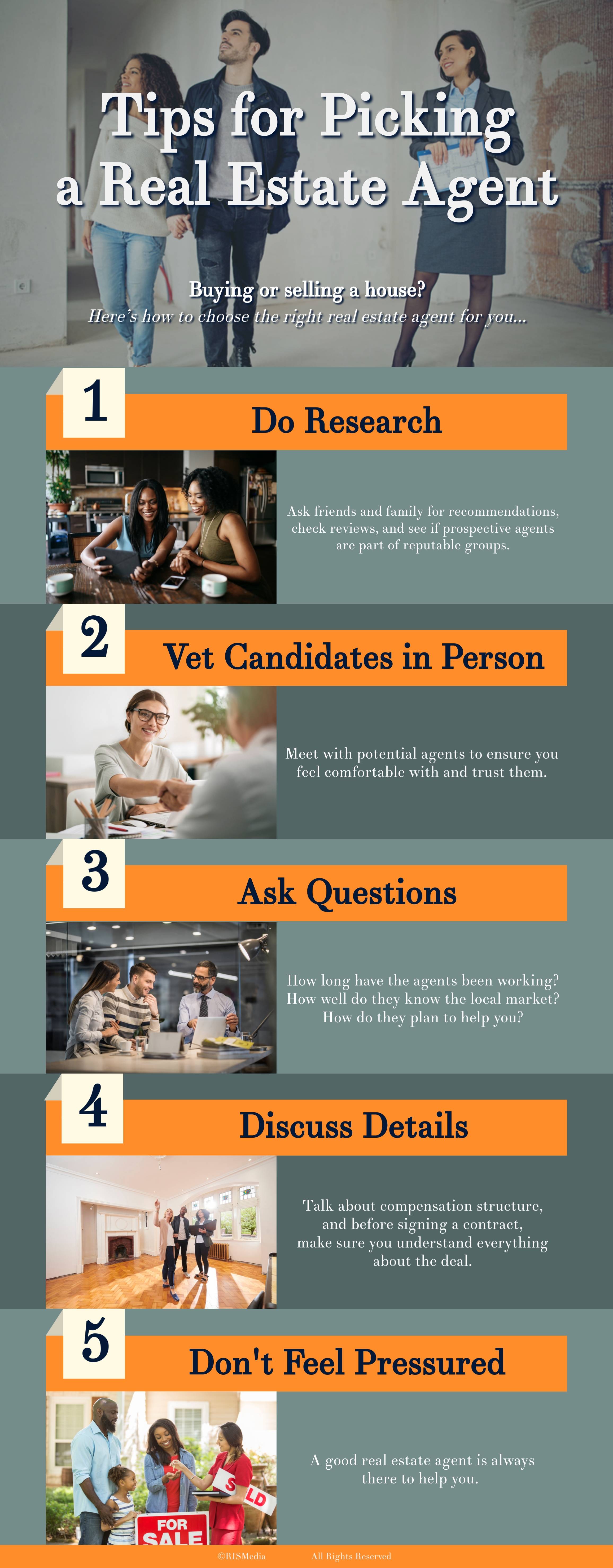

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This means that you will need to study at least 2 hours per week for 3 months.

This is the last step before you can take your final exam. In order to become a real estate agent, your score must be at least 80%.

All these exams must be passed before you can become a licensed real estate agent.